The Actuarial Career

What is an actuary? The Canadian Institute of Actuaries describes the profession as follows:

" Actuaries are business professionals who apply their knowledge of mathematics - particularly of probability, statistics and risk theory - to real-life financial problems involving future uncertainty. These uncertainties are usually associated with life insurance, property and casualty insurance, annuities, pension or other employee benefit plans, or providing evidence in courts of law on the value of lost future earnings."

More information can be found at www.beanactuary.org

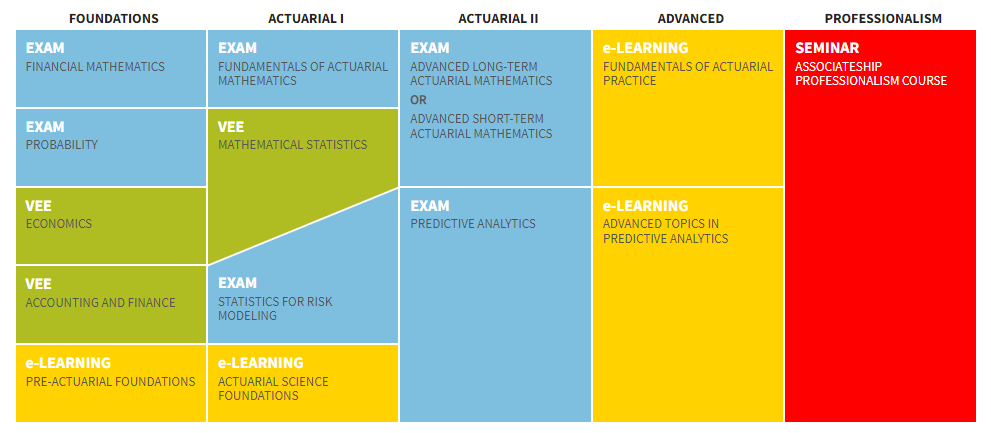

The new (2022) education and examination process leading to the ASA (associate of the Society of Actuaries) designation is outlined below.

A more detailed breakdown of the ASA pathway can be found on the Society of Actuaries website (https://pathways.soa.org/designations/asa2022)

Actuarial Science at Acadia

At Acadia University, we prepare you for the following Exam and Validation by Educational Experience (VEE) requirements listed above:

VEE requirements:

Exam Requirements:

- Probability (P)

- Financial Mathematics (FM)

- Fundamentals of Actuarial Mathematics (FAM)

- Advanced Long-Term Actuarial Mathematics (ALTAM)

- Advanced Short-Term Actuarial Mathematics (ASTAM)*

- Statistics for Risk Modeling (SRM)

*To be offered in the near future

If you are interested in pursuing acturial science at Acadia, please contact Dr. Iain Beaton (iain.beaton@acadiau.ca).

I 1000 and 2000 Level Prerequisite Courses

Some of courses listed below are 3000 and 4000 level courses with a number of prerequisites. To put yourself in the best position to take these courses in your 3rd and 4th year the following courses should be taken in your 1st and 2nd year:

- MATH 1013 Introductory Calculus 1

- MATH 1023 Introductory Calculus 2

- MATH 1333 Linear Algebra (or MATH 1323 Matrix Algebra)

- MATH 2013 Advanced Calculus

- MATH 2213 Applied Probability Science/Engineering

- MATH 2223 Applied Statistics for Science

NOTE: No single course listed below requires all of these courses as prerequisites. This list is meant to be a general guide for someone looking to take every acturial science at Acadia. If you do not have some of the prerequisite courses, it is likely you can still take some of the acturial science courses listed below. For more information, please contact Dr. Iain Beaton (iain.beaton@acadiau.ca).

II VEE -Economics

The following Economics courses will provide you with the courses you need to satisfy the VEE credit in Economics required by the Society of Actuaries.

-

ECON 1013 Microeconomic Principles

-

ECON 1023 Macroeconomic principles

Upon completion of the above courses you can apply for your VEE-Economics credit on the Society of Actuaries website (https://www.soa.org/education/exam-req/edu-vee/)

III VEE - Accounting and Finance

The following Business courses will provide you with the courses you need to satisfy the VEE credit in Accounting and Finance required by the Society of Actuaries.

-

BUSI 2033 Financial Accounting 2 (prerequisite: BUSI 1013)

-

BUSI 2233 Fundamentals of Finance 2 (prerequisite: BUSI 2223)

IV VEE - Mathematical Statistics

The following Mathematics and Statistics course will provide you with the courses you need to satisfy the VEE credit in Mathematical Statistics required by the Society of Actuaries .

-

MATH 4213 Mathematical Statistics (prerequisite: MATH 3213)

NOTE: MATH 3213 has a number of prerequisites, see Section I for the courses which should be completed in your 1st and 2nd year.

V Actuarial Exams

The courses listed below will provide students with a solid understanding of the material for each exam. Additional studying should be done in the months leading up to the exam date. Here are links for two useful resources when studying for the SOA exams:

-

Sample Online P and FM Exams (https://www.soa.org/education/exam-req/syllabus-study-materials/edu-exam-p-online-sample/)

-

Past SOA Exams and Solutions (https://www.soa.org/education/exam-req/syllabus-study-materials/edu-multiple-choice-exam/)

NOTE: Some courses listed below have a number of prerequisites, see Section I for the courses which should be completed in your 1st and 2nd year.

If you are interested in writing an actuarial exam contact Dr. Iain Beaton (iain.beaton@acadiau.ca)

Exam - Probability (P)

Exam P is a 3 hour multiple–choice examination. The material for this exam covers fundamental probability tools for quantitatively assessing risk. The application of these tools to problems encountered in actuarial science is emphasized. A thorough command of the supporting calculus is assumed. Additionally, a very basic knowledge of insurance and risk management is also assumed.

The following Mathematics and Statistics course will prepare you to write the Exam P offered by the Society of Actuaries.

-

MATH 3213 Probability (prerequisite: MATH 2223 and MATH 2013)

Information regarding this exam can be found on the Society of Actuaries website (https://www.soa.org/education/exam-req/edu-exam-p-detail/)

Exam - Financial Mathematics (FM)

The FM Exam is a 2.5 hour multiple–choice examination with 30 questions. The material for this exam covers the fundamental concepts of financial mathematics, and how those concepts are applied in calculating present and accumulated values for various streams of cash flows as a basis for future use in: reserving, valuation, pricing, asset/liability management, investment income, capital budgeting and valuing contingent cash flows. A basic knowledge of calculus and an introductory knowledge of probability is assumed.

The following Mathematics and Statistics course will prepare you to write the Exam FM offered by the Society of Actuaries.

-

MATH 2633 Theory of Interest (prerequisite: MATH 1023)

Information regarding this exam can be found on the Society of Actuaries website (https://www.soa.org/education/exam-req/edu-exam-fm-detail/)

Exam - Fundamentals of Actuarial Mathematics (FAM)

The FAM exam is 3.5 hours in length and consists of 40 multiple-choice questions. The material is split in to two sections: short-term and long-term. The material for the short-term section of the examination covers important actuarial methods that are useful in modeling. This includes foundational principles of ratemaking and reserving for short-term coverages. A thorough knowledge of calculus, probability (as covered in Exam P), and mathematical statistics (as covered in VEE Mathematical Statistics) is assumed. The material for the long-term section of the examination covers the theoretical basis of contingent payment models and the application of those models to insurance and other financial risks. A thorough knowledge of calculus, probability (as covered in Exam P), mathematical statistics (as covered in VEE Mathematical Statistics) and interest theory (as covered in Exam FM) is assumed.

The following Mathematics and Statistics courses will prepare you to write the Exam FAM offered by the Society of Actuaries.

-

MATH 3803 Fundamental Long-Term Actuarial Mathematics (prerequisite: MATH 3213, MATH 2633)

-

MATH 3813 Fundamental Short-Term Actuarial Mathematics (prerequisite: MATH 3213)

Information regarding this exam can be found on the Society of Actuaries website (https://www.soa.org/education/exam-req/edu-exam-fam//)

Exam - Advanced Long-Term Actuarial Mathematics (ALTAM)

The ALTAM Exam is a three-hour exam consisting of 60 points of written-answer questions. The material for Exam ALTAM includes more advanced contingent payment models and the application of those models to insurance and other financial risks. A thorough knowledge of calculus, probability (as covered in Exam P), mathematical statistics (as covered in VEE Mathematical Statistics) interest theory (as covered in Exam FM), and the fundamentals of long-term actuarial mathematics (as covered in FAM) is assumed. NOTE: Only one of the ALTAM or ASTAM exams is required

The following course will prepare you to write the Exam ALTAM offered by the Society of Actuaries.

- MATH 4803 Fundamental Long-Term Actuarial Mathematics (prerequisite: MATH 3803)

Information regarding this exam can be found on the Society of Actuaries website (https://www.soa.org/education/exam-req/edu-exam-altam/)

Exam - Advanced Short-Term Actuarial Mathematics (ASTAM)

The ASTAM Exam is a three-hour exam consisting of 60 points of written-answer questions. The material for Exam ASTAM includes more advanced actuarial methods that are useful in modeling, as well as ratemaking and reserving for short-term coverages. A thorough knowledge of calculus, probability (as covered in Exam P), mathematical statistics (as covered in VEE Mathematical Statistics), and the fundamentals of short-term actuarial mathematics (as covered in FAM) is assumed. NOTE: Only one of the ALTAM or ASTAM exams is required.

The following course will prepare you to write the Exam ASTAM offered by the Society of Actuaries.

- MATH 4813 Advanced Short-Term Actuarial Mathematics* (prerequisite: MATH 3813)

*To be offered in the near future

Information regarding this exam can be found on the Society of Actuaries website (https://www.soa.org/education/exam-req/edu-exam-astam/)

Exam - Statistics for Risk Modeling (SRM)

The SRM exam is a 3.5 hour exam that consists of 35 multiple-choice questions. The material for this exam overs introductory methods and models for analyzing data. This includes regression models (including the generalized linear model), time series models, principal components analysis, decision trees, and cluster analysis. Additionally you should able to apply methods for selecting and validating models. A thorough knowledge of calculus, probability (as covered in Exam P) and mathematical statistics (as covered in VEE Mathematical Statistics) is assumed.

The following Mathematics and Statistics courses will prepare you to write the Exam SRM offered by the Society of Actuaries.

-

MATH 3233 Regression (prerequisite: One of MATH 1323 or MATH 1333, and one of MATH 2223 or MATH 2243)

-

MATH 3283 Time Series (prerequisite: One of MATH 2223 or MATH 2243)

-

MATH 3293 Statistical Learning (prerequisite: One of MATH 2223 or MATH 2243)

Information regarding this exam can be found on the Society of Actuaries website (https://www.soa.org/education/exam-req/edu-exam-srm-detail/)